|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

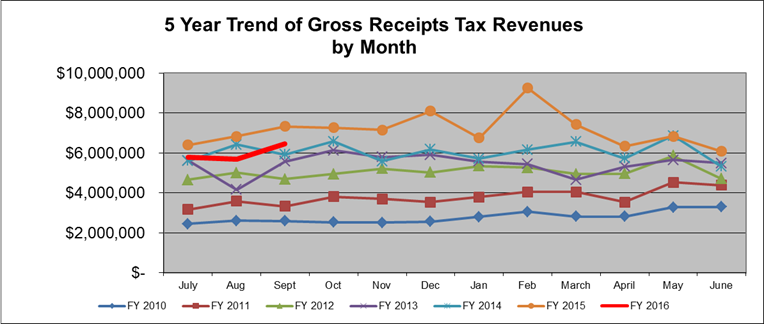

Rows (1-18) show the actual monthly

gross receipts (GRT) collections for the General Fund. In row (21) the average monthly GRT is

calculated for each month. Row (22)

shows |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

what percentage of the annual total

each month is for the FY 93-11 period.

February receipts are 9.07% of the annual GRT and it is the highest

single month. March and Jan. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the least productive GRT

months. Row (25) shows what needs to

be collected in FY 2010 to meet the annual GRT budget if FY 2010 follows the

normal trends shown in row (21) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Row (28) shows the actual GRT for

each month during FY 2010. Row (31)

shows the projected annual deficit or surplus for FY 2010 based on the actual

GRT received in row (18) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and the normal trend shown in row

(21). The projections shown in row

(31) are cumulative for the fiscal year.

These projections should not be considered reliable until |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September or October when

three-four months of actual GRT returns are known. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

July |

Aug |

Sept |

Oct |

Nov |

Dec |

Jan |

Feb |

March |

April |

May |

June |

Total |

|

|

|

|

|

Historical Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

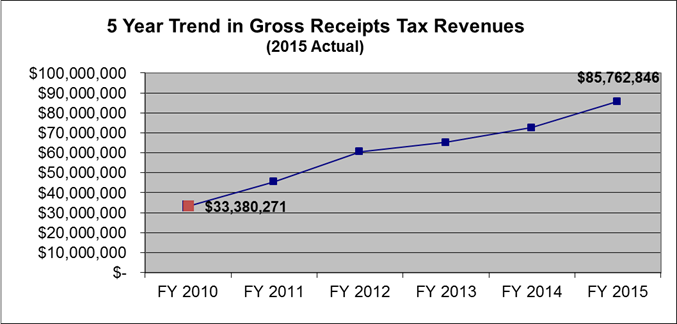

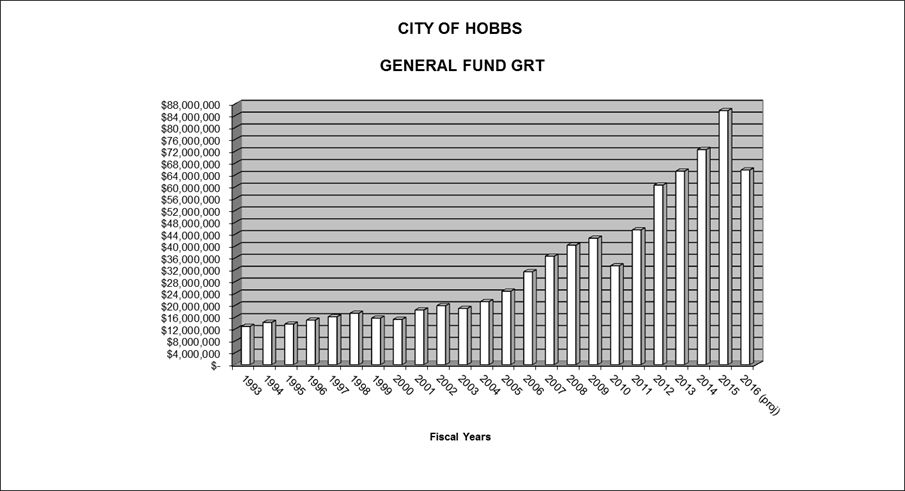

FY 1993 |

$

1,049,860 |

$

1,070,917 |

$

1,017,179 |

$

1,209,973 |

$

967,352 |

$

1,065,448 |

$

1,030,820 |

$

1,118,555 |

$

923,729 |

$

1,251,922 |

$

1,091,188 |

$

1,124,426 |

$

12,921,369 |

|

|

|

|

| 2 |

FY 1994 |

$

1,255,659 |

$

1,219,096 |

$

1,164,751 |

$

1,184,537 |

$

1,120,774 |

$

1,274,187 |

$

1,151,443 |

$

1,461,393 |

$

958,670 |

$

1,203,108 |

$

1,132,366 |

$

1,157,523 |

$

14,283,507 |

|

|

|

|

| 3 |

FY 1995 |

$

1,093,545 |

$

1,053,740 |

$

1,195,967 |

$

1,114,980 |

$

1,075,597 |

$

1,078,587 |

$

1,067,229 |

$

1,414,084 |

$

950,276 |

$

1,268,874 |

$

1,134,320 |

$

1,249,100 |

$

13,696,299 |

|

|

|

|

| 4 |

FY 1996 |

$

1,231,803 |

$

1,247,583 |

$

1,248,731 |

$

1,229,183 |

$

1,257,021 |

$

1,245,837 |

$

1,149,191 |

$

1,407,358 |

$

1,187,513 |

$

1,163,384 |

$

1,250,615 |

$

1,426,738 |

$

15,044,957 |

|

|

|

|

| 5 |

FY 1997 |

$

1,242,449 |

$

1,347,926 |

$

1,382,128 |

$

1,358,148 |

$

1,364,735 |

$

1,295,825 |

$

1,433,949 |

$

1,515,023 |

$

1,255,771 |

$

1,298,505 |

$

1,119,129 |

$

1,574,843 |

$

16,188,431 |

|

|

|

|

| 6 |

FY 1998 |

$

1,496,904 |

$

1,597,051 |

$

1,387,251 |

$

1,323,909 |

$

1,559,593 |

$

1,348,068 |

$

1,467,670 |

$

1,550,608 |

$

1,385,013 |

$

1,584,848 |

$

1,246,537 |

$

1,407,829 |

$

17,355,281 |

|

|

|

|

| 7 |

FY 1999 |

$

1,545,585 |

$

1,492,322 |

$

1,908,511 |

$

1,263,522 |

$

1,369,943 |

$

1,170,055 |

$

1,222,407 |

$

1,302,085 |

$

914,903 |

$

1,333,853 |

$

1,147,445 |

$

1,040,038 |

$

15,710,669 |

|

|

|

|

| 8 |

FY 2000 |

$

1,396,124 |

$

1,169,774 |

$

1,253,549 |

$

1,059,921 |

$

1,102,007 |

$

1,584,896 |

$

1,278,509 |

$

1,261,377 |

$

1,286,597 |

$

1,296,670 |

$

1,205,795 |

$

1,411,725 |

$

15,306,944 |

|

|

|

|

| 9 |

FY 2001 |

$

1,547,415 |

$

1,334,603 |

$

1,594,133 |

$

1,467,172 |

$

1,523,262 |

$

1,475,733 |

$

1,324,361 |

$

1,659,374 |

$

1,407,882 |

$

1,857,586 |

$

1,359,908 |

$

1,913,420 |

$

18,464,849 |

|

|

|

|

| 10 |

FY 2002 |

$

1,963,447 |

$

1,775,214 |

$

1,797,353 |

$

1,714,476 |

$

1,838,860 |

$

1,768,536 |

$

1,445,741 |

$

1,724,230 |

$

1,429,203 |

$

1,481,091 |

$

1,324,605 |

$

1,642,403 |

$

19,905,159 |

|

|

|

|

| 11 |

FY 2003 |

$

1,506,139 |

$

1,736,332 |

$

1,582,355 |

$

1,436,144 |

$

1,519,188 |

$

1,332,489 |

$

1,653,874 |

$

1,670,312 |

$

1,502,270 |

$

1,839,625 |

$

1,428,268 |

$

1,793,555 |

$

19,000,551 |

|

|

|

|

| 12 |

FY 2004 |

$

1,787,179 |

$

1,874,965 |

$

1,740,392 |

$

1,901,724 |

$

1,591,960 |

$

1,853,339 |

$

1,421,207 |

$

2,013,104 |

$

1,751,423 |

$

1,703,668 |

$

1,805,663 |

$

1,832,097 |

$

21,276,721 |

|

|

|

|

| 13 |

FY 2005 |

$

1,854,511 |

$

1,966,942 |

$

1,902,550 |

$

1,934,886 |

$

1,883,358 |

$

1,974,657 |

$

1,909,537 |

$

2,246,326 |

$

1,992,746 |

$

2,325,063 |

$

2,492,341 |

$

2,324,602 |

$

24,807,520 |

|

|

|

|

| 14 |

FY 2006 |

$

2,288,671 |

$

2,528,685 |

$

2,324,564 |

$

2,465,626 |

$

2,655,948 |

$

2,501,298 |

$

2,650,133 |

$

2,958,194 |

$

2,853,114 |

$

2,666,699 |

$

2,851,448 |

$

2,623,388 |

$

31,367,769 |

|

|

|

|

| 15 |

FY 2007 |

$

2,578,140 |

$

3,266,654 |

$

3,178,121 |

$

2,734,679 |

$

3,186,340 |

$

3,218,605 |

$

2,895,925 |

$

3,295,981 |

$

2,984,894 |

$

2,928,949 |

$

3,208,111 |

$

3,135,735 |

$

36,612,132 |

|

|

|

|

| 16 |

FY 2008 |

$

3,264,294 |

$

3,395,406 |

$

3,157,724 |

$

3,255,981 |

$

3,277,893 |

$

3,389,741 |

$

3,179,788 |

$

3,517,675 |

$

3,417,829 |

$

3,311,425 |

$

3,976,623 |

$

3,214,008 |

$

40,358,387 |

|

|

|

|

| 17 |

FY 2009 |

$

3,528,192 |

$

3,905,126 |

$

3,850,785 |

$

3,806,096 |

$

3,989,080 |

$

4,260,188 |

$

3,453,806 |

$

3,905,134 |

$

3,429,054 |

$

2,962,780 |

$

2,951,606 |

$

2,646,555 |

$

42,688,402 |

|

|

|

|

| 18 |

FY 2010 |

$

2,451,199 |

$

2,617,251 |

$

2,599,971 |

$

2,524,216 |

$

2,519,766 |

$

2,569,348 |

$

2,809,350 |

$

3,066,473 |

$

2,817,258 |

$

2,822,733 |

$

3,276,794 |

$

3,305,913 |

$

33,380,271 |

|

|

|

|

| 19 |

FY 2011 |

$

3,177,097 |

$

3,580,294 |

$

3,335,455 |

$

3,808,790 |

$

3,701,475 |

$

3,538,887 |

$

3,790,904 |

$

4,044,933 |

$

4,057,583 |

$

3,543,250 |

$

4,537,394 |

$

4,391,649 |

$

45,507,712 |

|

$ 0.012500 |

|

|

| 20 |

FY 2012 |

$

4,654,840 |

$

5,017,084 |

$

4,685,581 |

$

4,941,725 |

$

5,217,450 |

$

5,019,105 |

$

5,341,376 |

$

5,265,846 |

$

4,943,766 |

$

4,965,042 |

$

5,863,581 |

$

4,703,418 |

$

60,618,814 |

|

$ 0.012250 |

|

|

| 21 |

FY 2013 |

$

5,626,060 |

$

4,164,833 |

$

5,572,700 |

$

6,132,022 |

$

5,801,762 |

$

5,905,149 |

$

5,571,555 |

$

5,442,808 |

$

4,651,485 |

$

5,308,134 |

$

5,644,374 |

$

5,489,268 |

$

65,310,149 |

|

$ 0.001250 |

|

|

| 22 |

FY 2014 |

$

5,595,087 |

$

6,411,180 |

$

5,917,201 |

$

6,582,812 |

$

5,592,693 |

$

6,172,596 |

$

5,709,227 |

$

6,164,337 |

$

6,554,075 |

$

5,722,893 |

$

6,864,060 |

$

5,314,572 |

$

72,600,732 |

|

$ 0.000625 |

|

|

|

FY 2015 |

$

6,402,668 |

$

6,831,952 |

$

7,322,431 |

$

7,267,059 |

$

7,157,385 |

$

8,099,741 |

$

6,747,068 |

$

9,256,622 |

$

7,424,667 |

$

6,344,409 |

$

6,832,494 |

$

6,076,350 |

$

85,762,846 |

|

|

|

|

|

FY 2016 |

$

5,772,740 |

$

5,699,234 |

$

6,460,706 |

|

|

|

|

|

|

|

|

|

$

17,932,680 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.026625 |

|

|

| 20 |

FY 93-15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 21 |

Average |

$

2,545,081 |

$

2,634,997 |

$

2,657,364 |

$

2,683,373 |

$

2,664,063 |

$

2,745,318 |

$

2,595,873 |

$

2,924,427 |

$

2,612,162 |

$

2,616,718 |

$

2,771,507 |

$

2,643,441 |

$

32,094,325 |

|

$ 0.001250 |

|

|

| 22 |

% of total |

7.93% |

8.21% |

8.28% |

8.36% |

8.30% |

8.55% |

8.09% |

9.11% |

8.14% |

8.15% |

8.64% |

8.24% |

100% |

|

|

|

|

| 23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 24 |

FY 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 25 |

Prelim. Budget |

$

5,011,762 |

$

5,188,824 |

$

5,232,870 |

$

5,284,086 |

$

5,246,060 |

$

5,406,068 |

$

5,111,781 |

$

5,758,769 |

$

5,143,857 |

$

5,152,829 |

$

5,457,639 |

$

5,205,453 |

$

63,200,000 |

|

|

|

|

| 26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 27 |

FY 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 28 |

Actual |

$

5,772,740 |

$

5,699,234 |

$

6,460,706 |

|

|

|

|

|

|

|

|

|

$

17,932,680 |

|

|

|

|

| 29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 30 |

FY 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 31 |

Proj. Diff. |

$

760,977 |

$

510,410 |

$

1,227,836 |

|

|

|

|

|

|

|

|

|

$

65,699,223 |

Projected |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

14% |

15% |

-2% |

16% |

20% |

12% |

31% |

4% |

-4% |

4% |

3% |

|

|

|

|

|

|

|

-13% |

-14% |

3% |

-6% |

-4% |

-15% |

-7% |

-3% |

-1% |

5% |

0% |

8% |

|

|

|

|

|

|

|

13% |

18% |

4% |

10% |

17% |

16% |

8% |

0% |

25% |

-8% |

10% |

14% |

|

|

|

|

|

|

|

1% |

8% |

11% |

10% |

9% |

4% |

25% |

8% |

6% |

12% |

-11% |

10% |

|

|

|

|

|

|

|

20% |

18% |

0% |

-3% |

14% |

4% |

2% |

2% |

10% |

22% |

11% |

-11% |

|

|

|

|

|

|

|

3% |

-7% |

38% |

-5% |

-12% |

-13% |

-17% |

-16% |

-34% |

-16% |

-8% |

-26% |

|

|

|

|

|

|

|

-10% |

-22% |

-34% |

-16% |

-20% |

35% |

5% |

-3% |

41% |

-3% |

5% |

36% |

|

|

|

|

|

|

|

11% |

14% |

27% |

38% |

38% |

-7% |

4% |

32% |

9% |

43% |

13% |

36% |

|

|

|

|

|

|

|

27% |

33% |

13% |

17% |

21% |

20% |

9% |

4% |

2% |

-20% |

-3% |

-14% |

|

|

|

|

|

|

|

-23% |

-2% |

-12% |

-16% |

-17% |

-25% |

14% |

-3% |

5% |

24% |

8% |

9% |

|

|

|

|

|

|

|

19% |

8% |

10% |

32% |

5% |

39% |

-14% |

21% |

17% |

-7% |

26% |

2% |

|

|

|

|

|

|

|

4% |

5% |

9% |

2% |

18% |

7% |

34% |

12% |

14% |

36% |

38% |

27% |

|

|

|

|

|

|

|

23% |

29% |

22% |

27% |

41% |

27% |

39% |

32% |

43% |

15% |

14% |

13% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| .125% GRT |

$ 277,092 |

$ 550,655 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

$ 860,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feb 04-Nov 04 |

|

$ 18,648,202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Feb 05-Nov 05 |

|

$ 23,644,573 |

26.79% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2005 |

$ 5,185,734 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2004 |

$ 5,341,428 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2004 |

$ 5,724,003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q4 2004 |

$ 5,792,902 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2005 |

$ 6,148,609 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 2005 |

$ 7,142,006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2005 |

$ 7,141,920 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|